Endow Iowa Tax Credit Increase Proposed by Iowa Community Foundations

CFNEIA

February 28, 2022

Nearly all the 2023 Endow Iowa 25% state tax credits have been accounted for and, without legislative action, its anticipated that applications will be added to the 2024 waitlist as early as this quarter. Since 2013, $6 million has been available annually through this program and demand for the tax credits has grown each year.

The program is utilized by a wide range of donors, with a majority of donations being $1,000 or less. The program is so successful that the credits are exhausted earlier and earlier each year. All 2021 credits were allocated by December 2020 and all 2022 credits were allocated via a waitlist by September 2021. As a result, all Endow Iowa tax credit applications submitted from September 2021 on have been added to the 2023 waitlist.

In order for this program to remain effective, community foundations across Iowa are proposing that the state legislature increase the annual allocation from $6 million per year to $10 million per year and reduce the maximum amount of tax credits awarded to an individual taxpayer to $100,000 annually (currently set at $300,000 annually).

“The demand we are seeing for the program is a good problem. Iowans are investing in endowed funds at record rates, but now they are waiting up to two years to realize this tax advantage,” said Kaye Englin, president and CEO of the Community Foundation of Northeast Iowa and Iowa Council of Foundations’ Board member.

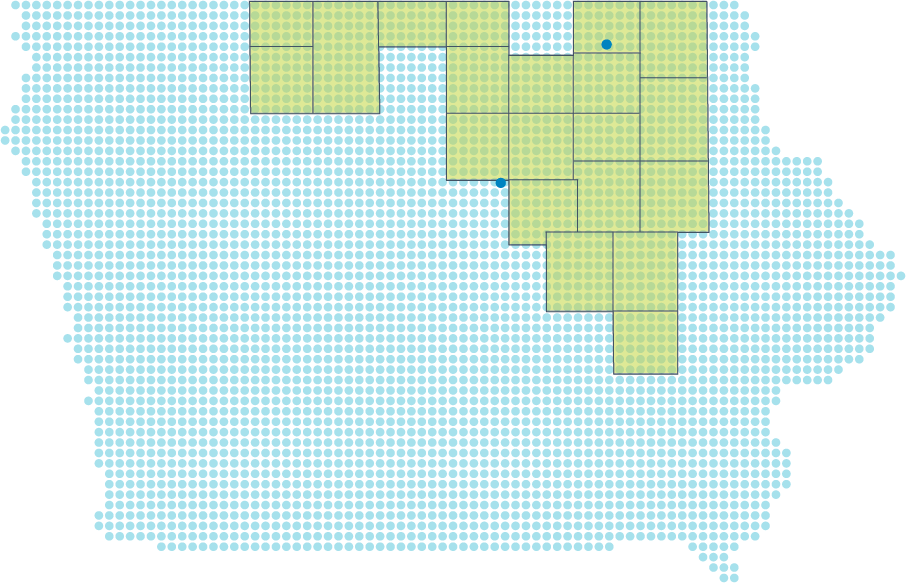

Endow Iowa tax credits are awarded on a first-come, first-served basis to donors who make a gift to a permanent endowment fund that benefits an Iowa charitable cause at a qualified community foundation in Iowa. Qualified community foundations are those accredited by National Standards for U.S. Community Foundations such as the Community Foundation of Northeast Iowa and its 23 affiliate foundations.

For each public tax credit dollar allocated, four private philanthropy dollars are leveraged. Since the inception of the Endow Iowa Tax Credit program, Iowa community foundations have leveraged more than $336 million in permanent endowment fund gifts. The contributions were made through 43,564 donations. The beauty of endowment funds is that these dollars will continue to grow in perpetuity, improving lives for Iowans both now and for generations to come. Last year alone, Endow Iowa funds at Iowa community foundations granted over $20 million to nonprofits and charitable causes in the state.

“Without question, the program has been a huge success and a model for growing community-based endowments. Endow Iowa not only benefits Iowa donors, but also the nonprofits, charitable causes and communities they love,” Englin said.

A list of Endow Iowa eligible funds held with the Community Foundation of Northeast Iowa and its affiliates can be found at www.cfneia.org/endowiowaeligible.

More information about the Endow Iowa Tax Credit Program can be found at www.cfneia.org/endowiowa.

Questions can be directed to the Community Foundation of Northeast Iowa at 319-287-9106.